Clique aqui para baixar o arquivo, imprima 60 páginas frente e verso e encaderne.

The content included in this post is designed for informational purpose and every attempt at accuracy has been made. It is sold to you with the understanding that the Publisher is not enganging in providing legal or accounting advice or other professional services. If such legal, accounting or professional assistance is required, please consult with na attorney, accountant, or other prefessional.

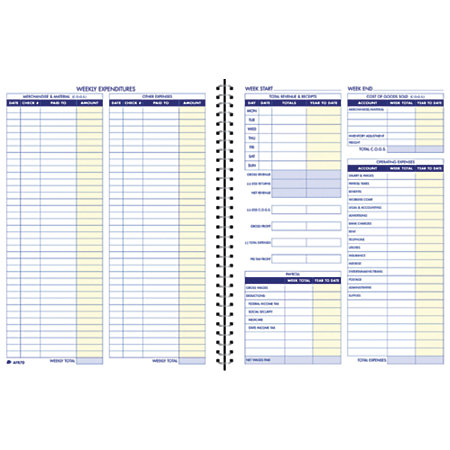

Weekly Bookkeeping

Complete weekly record keeping jornal to assist in the documentation of revenue and expenditures as they pertain to business.

With the many concerns today´s small business owner in mind, Adams developed this series of record keeping journals. The weekly Bookeeping record has been carrefully designed to record business expenditures and maintain a running total of revenue and profits. A complete summary of each week´s business can be recorded ans updated on a simple two-page layout.

GLOSSARY

- Yearly Totals

- Space to bring cumulative weekly figures forward for a running year-to-date total on expenses, revenue and cost of goods sold.

- Gross Profit Calculator

- Designated space to determine gross weekly profit by totalling revenue less returns and cost of goods sold weely.

- Profit

- Pre-Tax profit determined by taking gross profit less total operating expenses.

- Daily Journal

- Entry área for daily recording of revenue and receipts.

- Payroll

- Total weekly and year to date gross wages paid and deductions taken.

Instructions for Weekly Bookkeeping Journal

- Record all expenditures made by cash or check.

- In the left-hand column, record al expenditures for merchandise and materials purchased for resale.

- In the right-hand column, record all other expenditures.

- At the end of the week , record the Merchandise and Materials weekly total in the first column under the Cost of Goods Sold heading “Week Total”.

- Record any inventory ajustments and freight costs, and sum to determine total “Cost o Goods Sold”.

- The expenses from the “Other Expenses” column should be summarized and recorded in the corresponding boxes in the “Week Total” column under “Operating Expenses” and “Non-Deductible Expenditures”. Then, sum the expenses in the “Total Expenses” and “Total Non-Deductible Expenditures” boxes.

- Add the amounts in the “Week Total” column to the amounts from the previous week´s “Year-to-Date” column and record the sum in the current week´s “Year-to-Date” column. (Note: This is not necessary during the first accounting period.)

- Record your daily total of revenue and recepits in the “Totals” column under the “Total Revenue & Receipts” category.

- You may record the year-to-date revenue for each day of the week by adding the previous week´s “Year-to-Date” amounts to the current week´s daily totals. This information can be useful to determine your cyclical patterns.

- Total your daily revenue and receipts in the box titled “Gross Revenue”, record the amount of returns for the week, and subtract these numbers to determine “Net Revenue”.

- Record and subtract “Cost of Goods Sold (C.O.G.S.)”, determined in the right-hand column, and post the “Gross Profit”.

- Finally, record and subtract “Total Expenses” to determine your “Pre-Tax Profit” for the week and year-to-date.

Leave A Comment